Understanding Initial Recognition of Property, Plant, and Equipment under IFRS

By Mindcypress

Property, plant, and equipment (PPE) play a significant role in the financial reporting of companies, representing tangible assets used in operations. Initial recognition of PPE is a crucial step in accounting for these assets, governed by IAS 16: Property Plant & Equipment. In this blog, we delve into the process of initial recognition of PPE as per the provisions of IAS 16, outlining key principles and considerations in a concise manner.

Definition of Property, Plant, and Equipment:

Property, plant, and equipment encompass tangible assets held for use in production, supply of goods or services, rental to others, or administrative purposes. These assets are expected to generate economic benefits over multiple periods and are distinct from inventory or financial instruments. Examples include land, buildings, machinery, and vehicles.

Criteria for Recognition:

According to IAS 16, PPE should be recognized in the financial statements when:

It is probable that future economic benefits associated with the asset will flow to the entity.

The cost of the asset can be reliably measured.

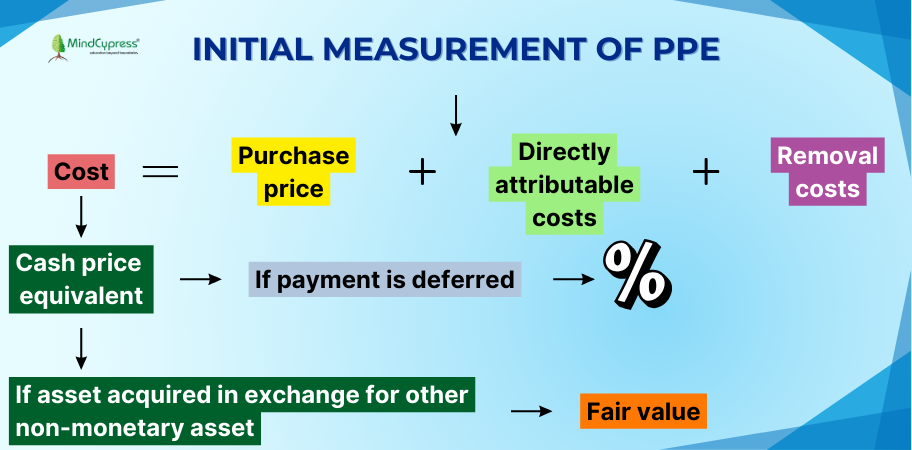

Measurement of Initial Recognition:

The initial recognition of PPE involves determining the cost of the asset, which includes all expenditures directly attributable to bringing the asset to its intended condition and location for use. This may include purchase price, delivery costs, installation charges, and initial testing expenses.

Components of Cost

Initially a PPE will be recognized at cost. There are three elements of cost:

- Purchase Price: The amount paid to acquire the asset, including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates.

- Directly Attributable Costs: Costs directly associated with bringing the asset to the location or condition necessary for it be used as intended by the management. Such as transportation and installation.

- Initial Estimates: Any initial estimates of decommissioning, dismantling, or restoration costs that are included in the asset's cost.

Subsequent Recognition

Once initially recognized, PPE subsequently can be carried at cost or a revaluation model. PPE is measured at cost less accumulated IAS 16 depreciation and any accumulated impairment losses. Depreciation is calculated systematically over the asset's useful life to reflect its consumption of economic benefits.

Disclosure Requirements

Entities are required to disclose significant accounting policies related to PPE, including the measurement basis used (e.g., cost model or revaluation model), IAS 16 depreciation methods, useful lives, and residual values. Additionally, disclosures about the carrying amount, accumulated depreciation, and any revaluation adjustments are necessary.

Conclusion

The initial recognition of property, plant, and equipment is a fundamental aspect of financial reporting under IAS 16. By adhering to the criteria outlined in IAS 16 and accurately measuring the cost of PPE, entities can provide transparent and reliable information about their tangible assets to stakeholders. Understanding the principles of initial recognition ensures compliance with accounting standards and facilitates informed decision-making regarding capital investments and asset management.

Are you interested to know more about the Finance Industry? Check the finance courses available on one of the leading online learning platforms, MindCypress.